Mission Statement

Northeast Private Wealth Management strives to deliver

optimal

financial advice, strategies and solutions.

Integrity, experience and extensive resources are the

cornerstone of our practice. We

are dedicated to helping

our clients define and achieve their objectives.

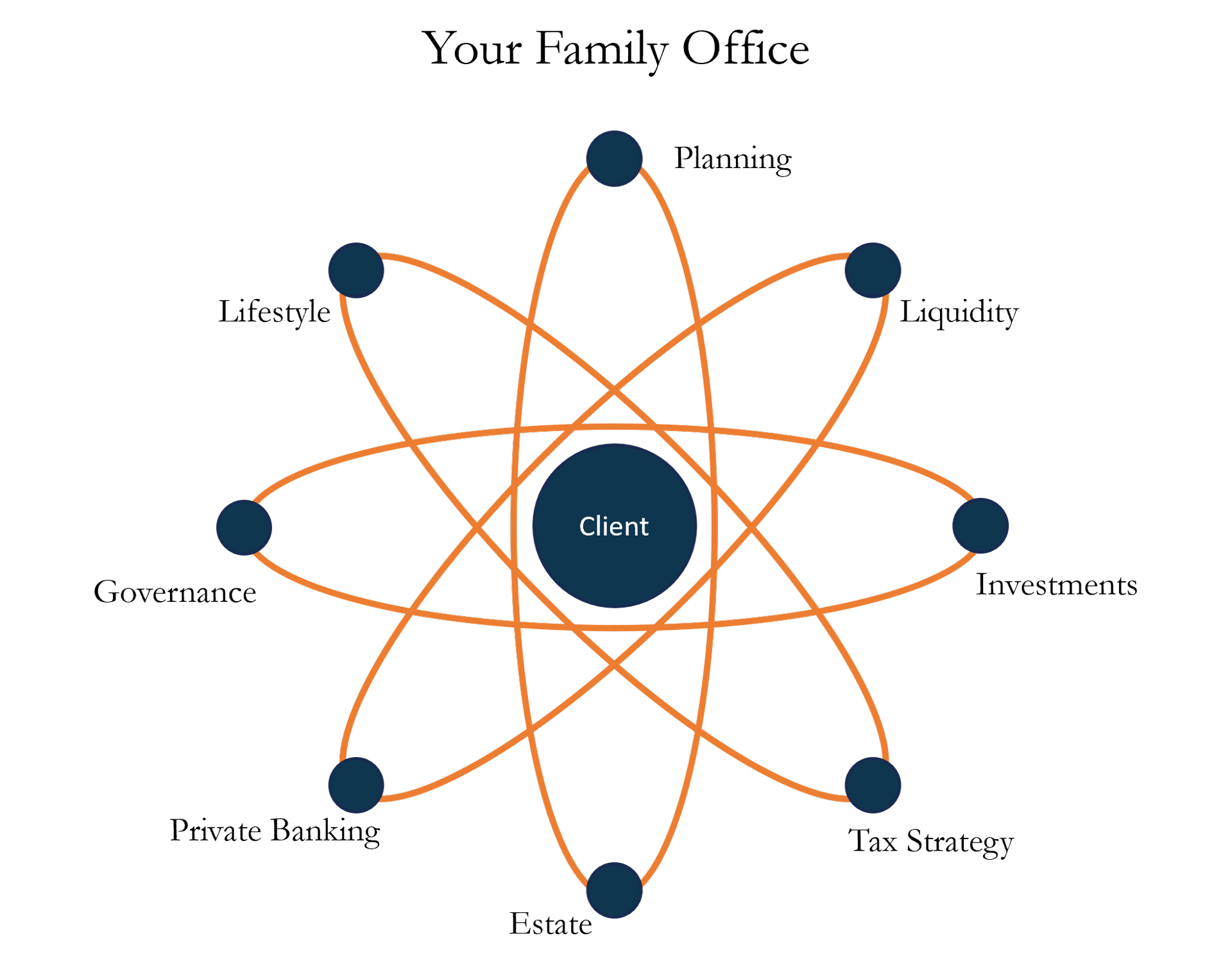

A look into our practice

Our clients are paramount to us. We’ve taken a lifetime of work and built a firm designed around the unique circumstances of affluent clients. We understand your needs are complex. That’s why we developed a highly personalized approach that aims to help you achieve your goals.

We believe our experience and access to industry resources set us apart. Throughout our long-term industry experience, we’ve developed meaningful relationships with many capital markets professionals and firms. The network we’ve built through the years offers our clients access to institutional caliber intellectual capital and allows us to truly deliver differentiated solutions.

Fiduciary

The Fiduciary Duty is a special relationship of trust and confidence an adviser has with its clients. As fiduciaries, we as investment advisers have an overarching duty to act in clients’ best interests, as well as the affirmative duties of care and loyalty. We must make full and fair disclosure of our conflicts of interest and ensure that these conflicts do not Influence our advice. These standards – affirmed by the Commission -- have served investors, the capital markets, the economy, and our profession well for decades and will continue to do so.

Our Approach

Our clients come first. It’s that simple. Northeast Private Wealth Management is solely dedicated to helping our clients achieve their objectives. We bring our experience, our network of professional resources and intellectual capital, and our commitment to deliver the highest caliber of personal service.

Investment Philosophy

At Northeast Private Wealth Management, we pride ourselves for being able to deliver a wide range of solutions to our clients, from sophisticated alternative investment strategies to traditional blue chip portfolios. We believe in thoughtful investment and strategic asset allocation. Often we are tasked with setting the course for multi-generational wealth strategies.

Extensive Network

Through the years, we’ve built an extensive network of industry professionals who provide capital markets insights and shape our perspective. We know the right questions to ask so that we can bring you a deeper understanding of market conditions and new opportunities for investing. We put all of our experience and resources to work for your benefit.

Private Wealth

Financial Planning

- Retirement Planning

- Education Planning

- Cash Flow Analysis

Portfolio Management

- Asset Management

- Private & Public Market Access

- Low-Cost Solutions

Tax Planning Strategies

- Pre-Transaction Planning

- Exit Strategies

- Tax-Efficient Portfolios

Insurance Solutions

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

Qualified Retirement Plans

- Defined Contribution & Benefit Plans

- Variable Cash Balance Plans

Estate & Multigenerational Planning

- Estate Planning Services

- Philanthropic Services

- Trust Accounts and Services

Customized Services

- Investment Research

- Business Succession Planning

- Captive Management Insurance Solutions

- Cash Management

- Endowments and Foundations

- Executive Financial Services

- Lending Products

Wealth Planning – CEO

- Financial Position Analysis

- Tax Minimization Strategies

- Risk Management & Insurance

- Retirement, Education & Expense Planning

- Business Exit Strategy

- Philanthropic Giving

- Estate & Multi-Generational Wealth Transfer

Investment Management – CIO

- Outsourced Chief Investment Officer

- Cash Flow Analysis

- Investment Research

- Asset Allocation

- Portfolio Construction

- Private Investment Ecosystem

Business Advisory - CFO

- M&A Advisory & Investment Banking

- Employee Benefits

- Private Banking & Lending

Operational Services - COO

- Consolidated Reporting

- Cybersecurity

- Special Assets

- Cash Management

Family Services – HR

- Lifestyle & Wellness Resources

- Healthcare Advisory

- Family Governance & Education

Our Team

Resources

CALCULATORS

A host of financial tools to assist you.

ARTICLES

Educate yourself on a variety of financial topics.

FLIPBOOKS

These magazine-style flipbooks provide helpful information on a variety of financial topics and illustrate key financial concepts.

VIDEOS

These engaging, short animations focus on a variety of financial topics and illustrate key financial concepts.

NEWSLETTERS

Timely newsletters to help you stay current.

Northeast Private Wealth Management is pleased to provide BNY Mellon | Pershing as custodian to our clients. BNY Mellon | Pershing serves the foremost wealth managers, RIAs, family offices and investment advisors around the world. BNY Mellon was founded by Alexander Hamilton in 1784 and it is one of the world's oldest financial institutions.

With $45.5 trillion in assets under custody and/or administration and $2.3 trillion in assets under management, BNY Mellon is the largest custodian in the world. It is the trusted choice to protect clients' assets and offering proven investment services. BNY Mellon is a recognized leader for providing global financial solutions driven by industry expertise, innovative solutions and powerful technology. Our clients can have peace of mind in knowing that BNY Mellon | Pershing is safekeeping their assets.

Our Office

135 Crossways Park Drive, Suite 404

Woodbury, NY 11797 linkedin linkedin twitter twitter